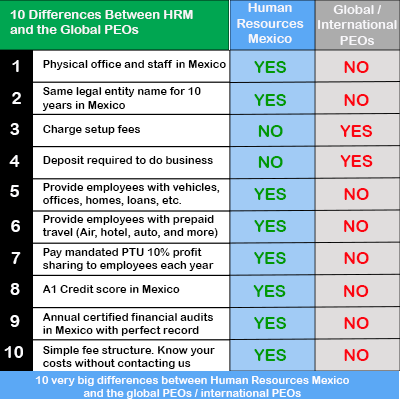

10 Differences between HRM & the Global PEO / International PEO / Employer of Record

4 minutes of your time - Franklin discusses the 10 differences between Human Resources Mexico and the Global PEO / International PEO / Employer of Record / Global Employment Solutions. Franklin D Frith II - General Manager / Principal

4 minutes of your time - Franklin discusses the 10 differences between Human Resources Mexico and the Global PEO / International PEO / Employer of Record / Global Employment Solutions. Franklin D Frith II - General Manager / Principal

10 Differences Between HRM & Global PEO / International PEO / Employer of Record

10 Differences Between HRM & Global PEO / International PEO / Employer of Record

1. Physical Offices in Mexico

Human Resources Mexico has physical offices with expert staff in Mexico to provide the services your employees will need in Mexico.

2. Same Legal Entity for 10 Years

Human Resources Mexico has operated under the same legal entity for 10 years with a perfect tax payment record

3. No Setup Fees

Human Resources Mexico charges NO SETUP FEES. ZERO.

4. No Deposits

Human Resources Mexico does not require a deposit equivalent to months of salaries up front in order to do start doing business in Mexico

5. Provide Employees with Vehicles, Offices, etc.

Human Resources Mexico can provide the employees with

- Vehicles

- Offices

- Homes

- Private Medical Insurance

- Interest free loans

- Food cards

- Gas cards

- Toll Road cards

- Matched savings fund

WITH NO additional fees to client

6. Prepaid Travel Arrangements

Human Resources Mexico provides prepaid travel arrangements like flights, hotels, and car rentals. We prepay these expenses and invoice you later with no additional fees charged

7. Pay Mandated PTU 10% Profit Sharing

Human Resources Mexico has been profitable going on 10 years. Therefore, all employees receive the mandatory 10% profit sharing every year

8. Excellent Credit Rating in Mexico

Human Resources Mexico has a Dun & Bradstreet Paydex rating of 80 / AA and an A1 credit rating with the National Credit Bureau in Mexico which is the best credit rating a company can receive

9. 3rd Party Financial Audits

Human Resources Mexico is subject to the Dictamen Fiscal / Financial Audit by a 3rd party who is certified by SAT, the tax authority in Mexico to ensure strict compliance with the tax laws and regulations

10. Simple Fee Structure

Human Resources Mexico charges a total cost markup factor on taxable compensation for our services. No markup or admin fees are applied to tax deductible items. Our fee structure is easy to understand and you always know what your costs are going to be without the need to consult with us.

We look forward to helping you expand to Mexico.

Human Resources Mexico has physical offices with expert staff in Mexico to provide the services your employees will need in Mexico.

2. Same Legal Entity for 10 Years

Human Resources Mexico has operated under the same legal entity for 10 years with a perfect tax payment record

3. No Setup Fees

Human Resources Mexico charges NO SETUP FEES. ZERO.

4. No Deposits

Human Resources Mexico does not require a deposit equivalent to months of salaries up front in order to do start doing business in Mexico

5. Provide Employees with Vehicles, Offices, etc.

Human Resources Mexico can provide the employees with

- Vehicles

- Offices

- Homes

- Private Medical Insurance

- Interest free loans

- Food cards

- Gas cards

- Toll Road cards

- Matched savings fund

WITH NO additional fees to client

6. Prepaid Travel Arrangements

Human Resources Mexico provides prepaid travel arrangements like flights, hotels, and car rentals. We prepay these expenses and invoice you later with no additional fees charged

7. Pay Mandated PTU 10% Profit Sharing

Human Resources Mexico has been profitable going on 10 years. Therefore, all employees receive the mandatory 10% profit sharing every year

8. Excellent Credit Rating in Mexico

Human Resources Mexico has a Dun & Bradstreet Paydex rating of 80 / AA and an A1 credit rating with the National Credit Bureau in Mexico which is the best credit rating a company can receive

9. 3rd Party Financial Audits

Human Resources Mexico is subject to the Dictamen Fiscal / Financial Audit by a 3rd party who is certified by SAT, the tax authority in Mexico to ensure strict compliance with the tax laws and regulations

10. Simple Fee Structure

Human Resources Mexico charges a total cost markup factor on taxable compensation for our services. No markup or admin fees are applied to tax deductible items. Our fee structure is easy to understand and you always know what your costs are going to be without the need to consult with us.

We look forward to helping you expand to Mexico.