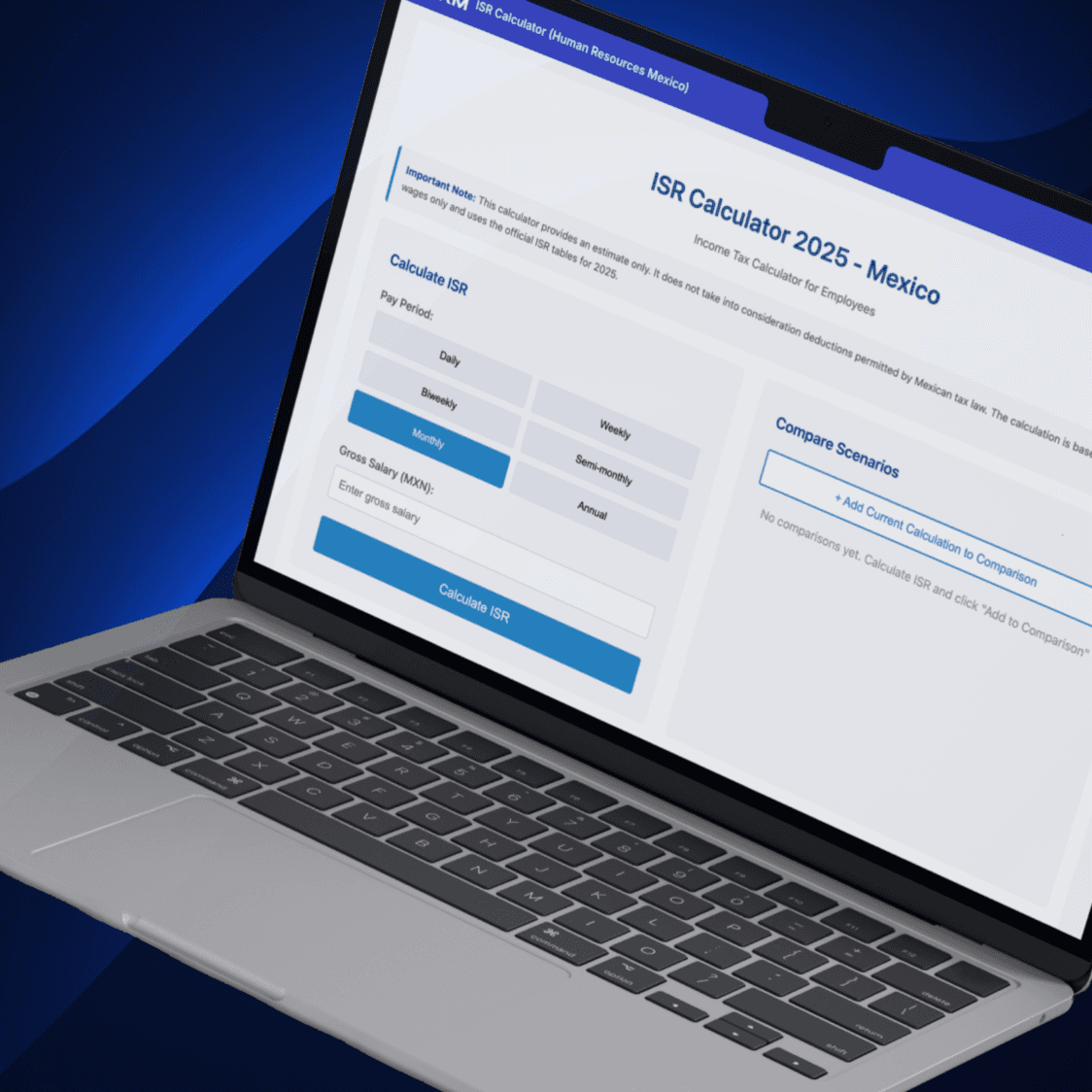

Updated for FY 2025

Mexico ISR

Calculator 2025

Estimate income tax and net salary for employees in Mexico with the official HR Mexico calculator.

What Is ISR?

Understanding the impact of Impuesto Sobre la Renta on your payroll.

Why it matters

Impuesto Sobre la Renta (ISR) is the standard income tax applied to the earnings of employees in Mexico. It is a progressive tax, meaning higher earners contribute a larger percentage of their income.

For employers, correctly calculating and withholding ISR is a critical compliance requirement. Errors can lead to significant penalties from the SAT (Servicio de Administración Tributaria) and labor disputes. The tax rates are updated annually, making it essential to use the latest tables for 2025.

¿Qué es el ISR?

Español

"El Impuesto Sobre la Renta (ISR) es un impuesto directo que se aplica a los ingresos que incrementan el patrimonio de un contribuyente. En México, es obligación del patrón retener este impuesto del salario del trabajador y enterarlo al SAT. Las tarifas se actualizan conforme a la inflación y otros factores económicos cada año."

How it works

Four simple steps to accurate tax calculation

Enter Gross Salary

Input the monthly gross salary amount. Choose between USD and MXN salary

1

Select Pay Period

Choose between weekly, biweekly, semi-monthly, or monthly calculations.

2

Add Parameters

Adjust for location (border zone vs. standard) and other taxable benefits.

3

View Result

Instantly see the ISR deduction and final Net Take-Home Pay.

4

Disclaimer: Illustrative purposes only. Actual amounts may vary based on location and specific payroll variables.

Monthly Breakdown

FY 2025

Gross Salary

$35,000.00

Lower Limit

$32,736.84

Surplus

$2,263.16

Tax on Surplus (23.52%)

$532.29

Fixed Fee

$6,141.95

Total ISR Withheld

-$6,674.24

Net Pay

$28,325.76

Try the ISR Calculator

Test different salary scenarios and see ISR impact in real time.

Key Facts

Essential information every employer should know about ISR in Mexico.

Important Details

Every employee in Mexico earning an income must pay ISR.

It is withheld from each paycheck (weekly, bi-weekly, or monthly).

Annual adjustments may be required in April.

Employers are legally responsible for calculating and submitting this tax.

Rates are progressive: earning more means a higher tax percentage.

Datos Clave

Español

Todo empleado que percibe ingresos en México debe pagar ISR.

Se retiene en cada pago de nómina (semanal, quincenal o mensual).

El ajuste anual se realiza típicamente en abril.

El patrón es responsable de retener y enterar este impuesto al SAT.

Las tasas son progresivas: a mayores ingresos, mayor porcentaje.

FAQs

Still have questions?

We're here to help you with any inquiries.